27+ calendar spread calculator

Web A calendar spread is a strategy used in options and futures trading. Calendar spreads are also.

Calendar Put Spread Calculator

Web A long calendar spread is a neutral trading strategy though in some instances it can be a directional trading strategy.

. Web This calculator is mainly geared towards US. Sell the February 89 call for 097 97. Certain holidays can also be excluded.

It is used when a trader expects a. Two positions are opened at the same time one long and the other short. Clicking on the chart icon on the Calendar Put Spread.

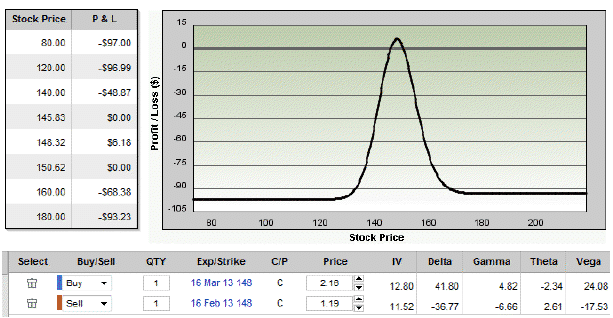

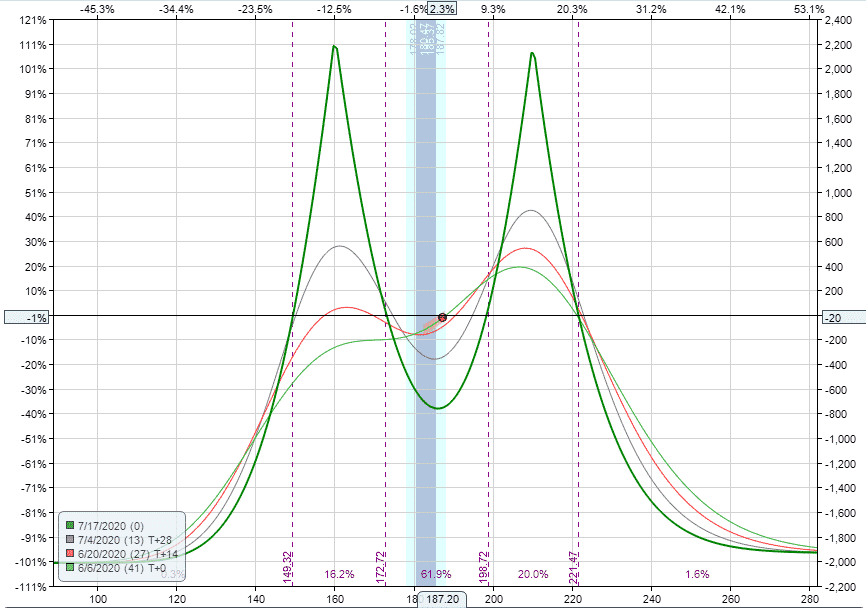

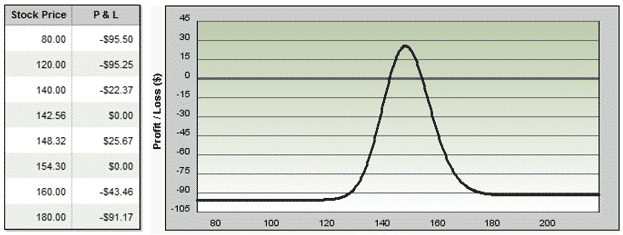

Web The Calendar Put Spread Calculator can be used to chart theoretical profit and loss PL for a calendar put position. Watch the video below to learn. Manage your finances with confidence ease.

Web Assume that Exxon Mobile XOM stock is trading at 8905 in mid-January you can enter into the following calendar spread. Web A long short calendar spread is used when the investment outlook is flat volatile in the near term but greater lesser return movements are expected in the future. Holidays but holidays specific to a given country can be entered manually.

Web Calendar Put Spread Calculator Search a symbol to visualize the potential profit and loss for a calendar put spread option strategy. Add to or Subtract From a Date Enter a start date and add or subtract any. Ad Stay on top of bills keep funds organized crush your financial goals.

What is a calendar call spread. What is a calendar put spread. Web The rate spread calculator generates the spread between the Annual Percentage Rate APR and a survey-based estimate of APRs currently offered on prime mortgage loans.

Add to or subtract from a date Home Calculators Date Calculator Date Calculator. Try Simplifi for free today. Web Calendar Call Spread Calculator Search a symbol to visualize the potential profit and loss for a calendar call spread option strategy.

Web This video provides step by step detail on how to calculate your profit or loss on a Calendar Spreadeven after several adjustments. Web A long calendar spread is a two-legged low volatility options strategy which means a trader indulges in executing two option contracts while trading with this strategy.

Become A Guru At Calendar Spreads

Long Calendar Call Spread Calendar Spreads The Options Playbook

Gross Profit Formula Examples Calculator With Excel Template

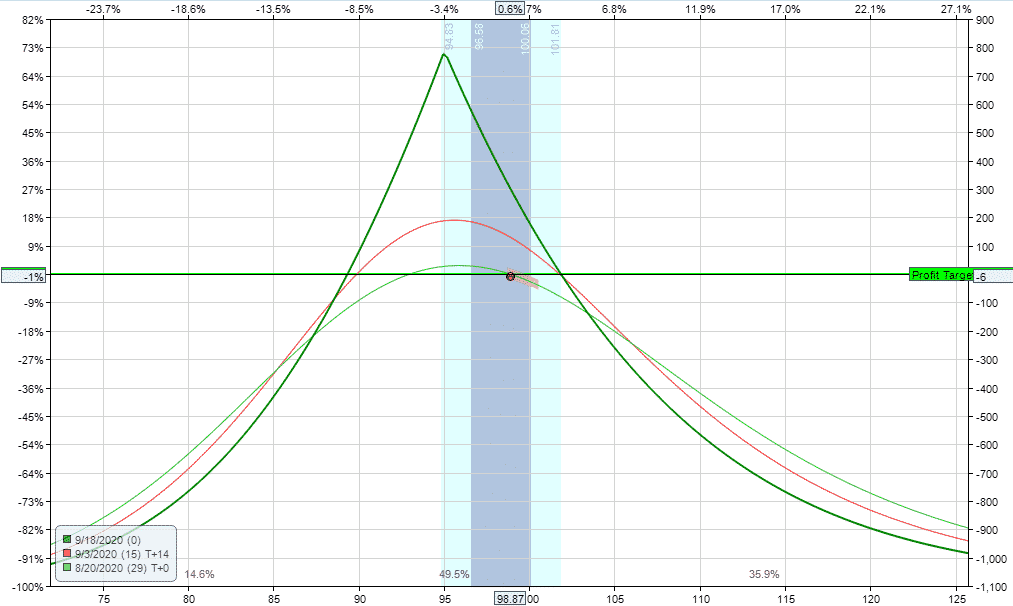

Calendar Spreads 101 Everything You Need To Know

Roboforex Review 2023 Should You Sign Up Or Not Test

How To Use Option Greeks To Calculate Calendar Call Spreads Profit Risk Youtube

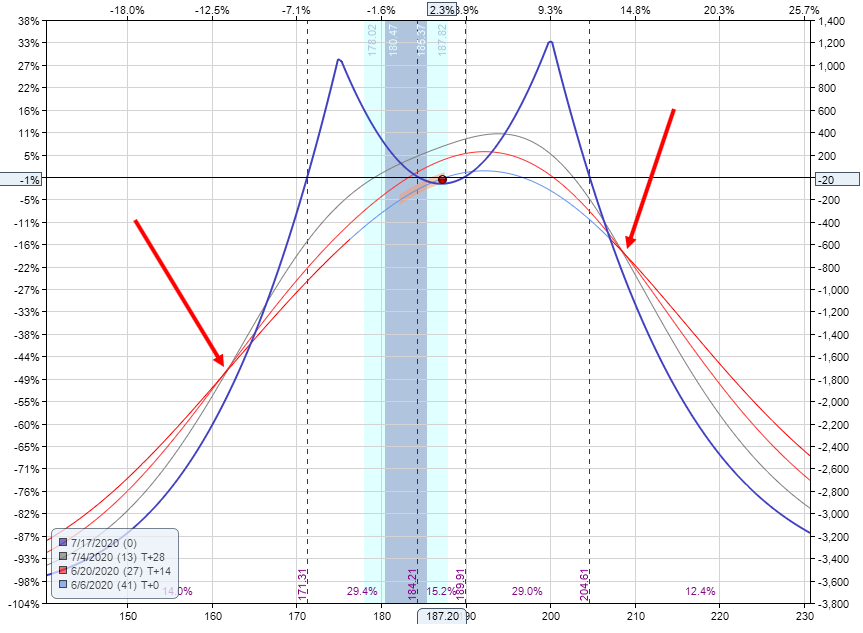

Double Calendar Spreads Ultimate Guide With Examples

Double Calendar Spreads Ultimate Guide With Examples

Calendar Call Spread Calculator

Trading Guide On Calendar Call Spread Aalap

Options Calculator

Trading Guide On Calendar Call Spread Aalap

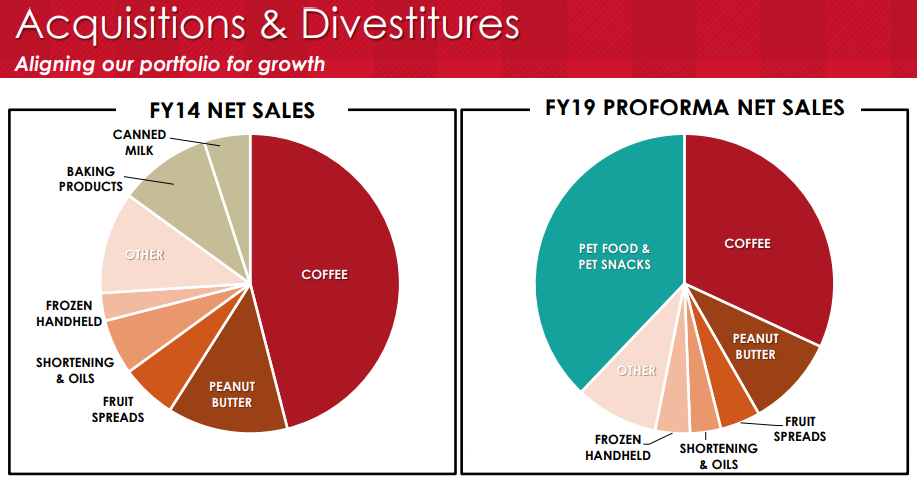

J M Smucker Back In A Jif Nyse Sjm Seeking Alpha

Options Spread Calculator

Become A Guru At Calendar Spreads

Tata Consultancy Servicess Pdf Pdf Financial Statement Empowerment

Defects And Performance Of Si Pv Modules In The Field An Analysis Energy Environmental Science Rsc Publishing Doi 10 1039 D2ee00109h